UClaim4Me – Covid-19 Replace

As a business we're dedicated to taking all cheap steps to make sure the security of our colleagues in the course of the Corona virus pandemic. We've been fastidiously monitoring info revealed by the Authorities and the Monetary Conduct Authority (FCA) and taking steps to adapt our working practices the place mandatory.

We're working a full service to our clients and stay dedicated to take action.

We've discovered that a number of the monetary organisations we work with have confirmed that they could expertise various ranges of delay in dealing with your ppi complaints while they give attention to their susceptible clients throughout this time. This does range lender by lender and we're chatting with the monetary establishments often for updates for you.

We'll proceed to finish as a lot work in your claims as we are able to throughout this era, we'll move on any updates or requests we do obtain relating to your declare and we'll maintain you up to date close to any delays.

Relaxation assured that our groups are working arduous to do all the things we are able to to course of your claims and we admire and thanks in your endurance and assist.

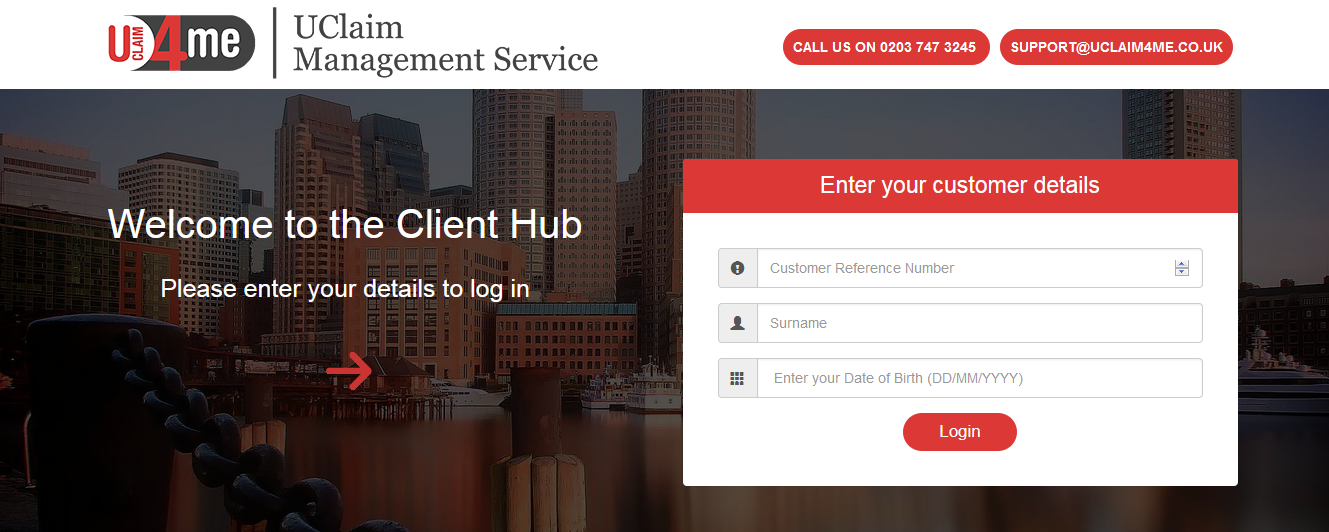

We admire that the Covid-19 virus could have impacted you o your companion financially by way of both redundancy, or by way of being classed as a ‘furloughed employee’. The excellent news is all lenders are prioritising clients who're struggling some type of monetary hardship. Please tell us if this is applicable to you by calling us on 0203 775 8891, or contacting us on assist@uclaim4me.co.uk or logging on to your hub at www.uclaim4me.co.uk/client-hub and we'll strive our easiest to work together with your lender to prioritise any potential refund you could be entitled to.

We thanks in your endurance and understanding throughout these difficult occasions.

About Fee Safety Insurance coverage (PPI)

PPI is designed to cowl any sort of finance agreements within the unlucky occasion of you popping out of labor as a consequence of an accident, illness, or unemployment.

PPI might be added to loans or bank cards, and even sure forms of mortgages, and has many alternative names together with:

- Accident, Illness & Unemployment Insurance coverage (ASU)

- Mortgage Safety

- Card Safety

- Gold, Silver or Bronze Cowl (usually supplied with Northern Rock and HBOS loans)

- Mortgage Care

Have I been Mis-Bought?

PPI was mis-sold on an industrial scale to individuals who didn’t ask for it, didn’t need it, didn’t want it or may by no means have made a declare on it if the necessity arose.

PPI mis-selling occurred if:

- It was added to your monetary agreements with out your consent.

- You had been by no means requested if you happen to already had a coverage in place that will cowl you in the identical means.

- It was not made clear that the coverage was non-obligatory, and never required to safe a mortgage or mortgage.

- Your employer illness profit can be sufficient to cowl your repayments, e.g. civil servants, members of the armed forces, nurses.

- You had been offered a coverage when you weren't in work, e.g. Pupil, Unemployed or Retired.

- You weren't advised concerning the many PPI exclusions which meant the coverage wouldn't pay out. The commonest exclusion is if you happen to had a pre-existing medical situation if you signed up.

Have you ever been “PLEVINED?”

“Plevined” is coined from the Plevin vs. Paragon Private Finance authorized case, the place the Supreme Courtroom dominated that Mrs Plevin was not knowledgeable concerning the quantity of secret fee (71.8%) paid to Paragon Private Finance by the Fee Safety Insurance coverage (PPI) supplier and that was unfair.Due to that ruling Mrs Plevin was entitled to a number of the PPI funds that she made to Paragon, plus 8% curiosity per yr.

The ruling has now paved the best way for extra individuals to additionally declare again unfair commissions paid to their lenders, even when a earlier PPI declare was rejected by the lender of Monetary Ombudsman Service. Even if you happen to knew what you had been doing, you had been doubtless mis-sold it and are rightfully owed your a refund.

THE PPI CLAIMS DEADLINE IS 29 AUGUST 2019*

1 in 9 adults are uncertain if they'd PPI**

We make claiming straightforward – NO WIN, NO FEE.

- PPI may be claimed again on a mortgage, mortgage or bank card

- Uclaim4me has gained over £104m thus far***

- We're profitable 93% of the time****

- Our clients profitable common declare is £1,303*****

UClaim4Me is an organization that has confirmed success in claiming again mis-sold fee safety insurance coverage and bank card fees. We provide recommendation and repair for shoppers, while guiding them by way of the complexities of the claims system.

UClaim4Me are authorised and controlled by the Monetary Conduct Authority in respect of regulated claims administration actions. We at all times act in your greatest pursuits. We additionally guarantee complete confidentiality and privateness, so don’t inform anybody else about your declare.

Right here at UClaim4Me we pleasure ourselves on our customer support, so in addition to gaining you compensation we’ll maintain you knowledgeable each step of the best way. Moreover we work on a no win, no price foundation, so that you solely pay UClaim4Me after we win your case.

UClaim4Me is a buying and selling type of Waterloo Options Restricted, Ground 1, Mander Home, Mander Centre, Wolverhampton, WV1 3NH.

Registered in England and Wales. Registered Workplace: Swinford Home, Albion Road, Brierley Hill, West Midlands, DY5 7EE, (Firm No 07671221) Waterloo Options Ltd is authorised and controlled by the Monetary Conduct Authority (Agency reference quantity: 620028).

ICO Reg No. Z3306183.

Rating: 4 out of Votes: 625